Winter Is Approaching: Strategies to Navigate Economic Downturns

Written on

Chapter 1: Understanding Economic Cycles

The atmosphere on Wall Street and in Silicon Valley is growing increasingly tense. With the Nasdaq entering a bear market and growth beginning to stall, several tech giants like Facebook, Netflix, and Salesforce are curtailing their hiring efforts. Economic cycles are a recurring theme. Below is guidance on how to endure these downturns.

Cycles Are Inevitable

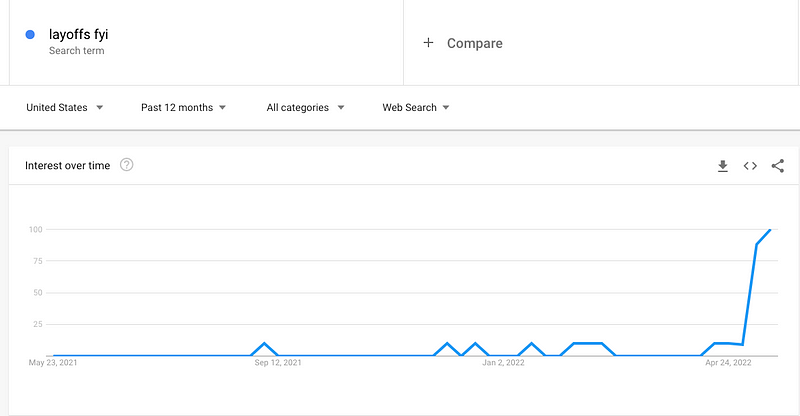

Hiring in the tech sector has become a rare opportunity. On May 9th, Uber's CEO Dara Khosrowshahi addressed employees, emphasizing the need to slow down hiring, reduce marketing expenses, and begin generating free cash flow. Uber isn’t the only one making cuts; in April, Robinhood laid off 9% of its employees, and companies like Netflix, Carvana, Facebook, Salesforce, and Wayfair are also halting hiring practices. Rumors suggest Amazon's retail division may soon follow suit. There's a noticeable spike in Google searches for Layoffs.fyi, a site that tracks startup layoffs.

The first quarter's earnings reports showcased a slowdown in growth and rising uncertainties, including war, inflation, and interest rates. Recent fluctuations in the stock market have left many investors uneasy. After a decade-long bull market, the tech industry is now facing a slowdown.

This transition from slower growth is impacting both public and private markets. Late-stage private companies are already adjusting to this new reality. For instance, in March, Instacart reduced its internal valuation from $39 billion to $24 billion, and there are speculations that Klarna, a buy-now-pay-later firm, is preparing for a down round. Without significant macroeconomic improvements, smaller startups are likely to feel this strain soon.

Economic cycles are a natural occurrence. Economies grow and contract, and the market swings between bullish and bearish phases. Inflation fluctuates, and Mr. Market often exhibits manic-depressive tendencies. Yet, humans tend to overlook cyclicality, which can lead to painful consequences. Recognizing this pattern is crucial, especially as history tends to repeat itself.

Historical Context of Market Bubbles

The concept of bubbles, where valuations become disconnected from fundamental metrics, is not new. Howard Marks, cofounder of Oaktree Capital Management, has noted that while technologies may evolve, human behavior remains constant. In his book "Bubble.com," Marks discusses how speculative manias have a tendency to recur, whether the asset in question is tulip bulbs or tech stocks. He underscores the danger of assuming "this time is different" in finance.

Warren Buffett further emphasizes that successful investing hinges not on the potential societal impact of an industry but rather on the competitive edge of individual companies. A century ago, radio was the groundbreaking technology, with RCA’s stock soaring to $114 in 1929, only to plummet below $3 by 1932. This serves as a reminder that high valuations do not guarantee favorable returns.

Assessing Business Viability

Paul Graham, the founder of Y Combinator, emphasizes the importance of understanding whether a business is "default alive" (capable of self-sustaining profitability) or "default dead" (reliant on external funding). Many entrepreneurs are unaware of their status, and Graham suggests that recognizing this early can significantly impact future decisions.

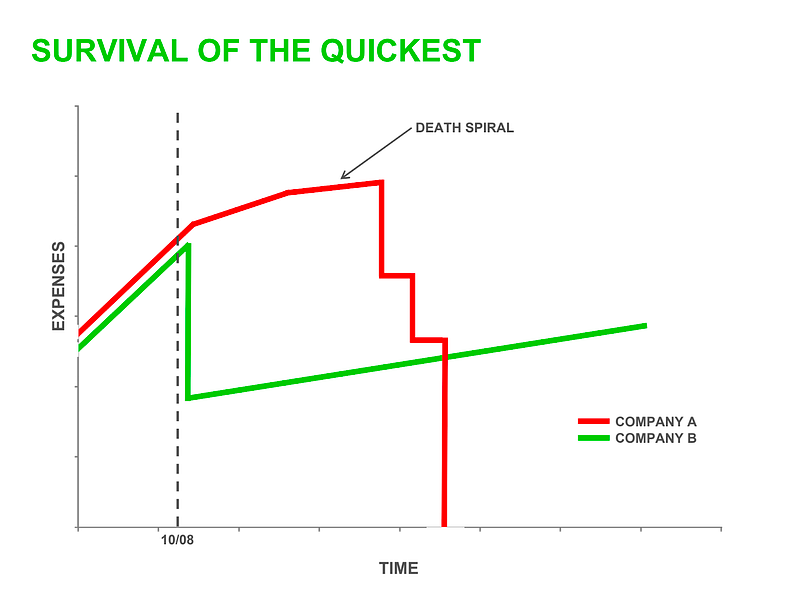

In a downturn, rapid hiring can be a dangerous strategy. Graham warns against equating fast growth with high spending. Sustainable growth often stems from a product that meets significant market needs, while excessive spending typically indicates inefficiencies.

Responding to Sudden Changes

Jeff Jordan, a partner at Andreessen Horowitz, has witnessed various market cycles and emphasizes the importance of taking swift action in response to abrupt changes in growth. Effective CEOs take ownership of challenges, mobilizing their teams to diagnose issues systematically.

The process involves identifying when problems emerged, whether they were gradual or sudden, and analyzing all relevant data across platforms and geographies. Understanding competitive actions is also crucial.

Preparing for Economic Challenges

Recently, Y Combinator advised its portfolio companies to brace for challenging fundraising conditions over the next six to twelve months. Startups that depend on investor funding may find themselves in precarious situations. Founders should prioritize staying alive, as those who plan effectively often gain market share when competitors falter.

Final Thoughts: Embrace the Cycle

The key takeaway is to recognize that economic cycles are natural. Maintain a disciplined approach to expenses, ensure your business is on a path to profitability, and act decisively when growth slows. Companies like Airbnb, Square, and Stripe emerged during tough times, highlighting the importance of resilience.

Prepare now for the upcoming economic challenges as discussed by Adam Taggart.

Explore the resurgence of frugal habits from the Great Depression era, emphasizing skills to navigate economic downturns.